3.6% profit on Diageo PLC in our upside view

Our information/charts are NOT buy/sell recommendations. Are strictly provided for educational purposes only. Trade at your own risk and analysis.

Contact our advisors through website chat 24/7.

Our information/charts are NOT buy/sell recommendations. Are strictly provided for educational purposes only. Trade at your own risk and analysis.

Contact our advisors through website chat 24/7.

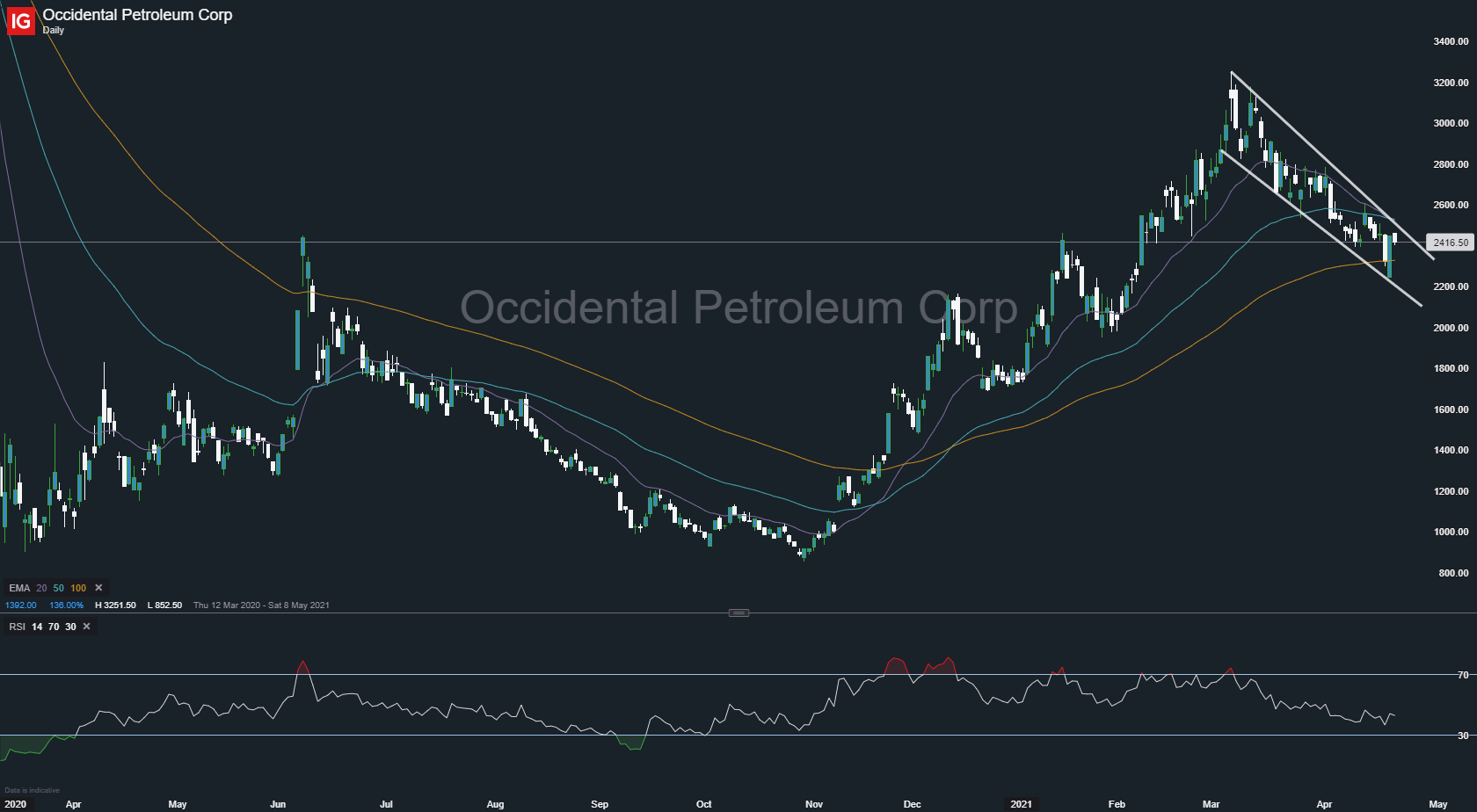

U.S. oil and gas producer Occidental Petroleum said federal drilling permits are moving forward in the Permian Basin shale field following a federal pause this year, but a longer-term ban could hurt U.S. oil output. Producers are likely to continue to be able to secure permits on existing federal leases, but Chief Executive Vicki Hollub said on Tuesday she was concerned about the possibility of a federal moratorium on new oil and gas leases going forward. The Biden administration is reviewing the federal oil and gas leasing program.

Our information/charts are NOT buy/sell recommendations. Are strictly provided for educational purposes only. Trade at your own risk and analysis.

Contact our advisors through website chat 24/7.

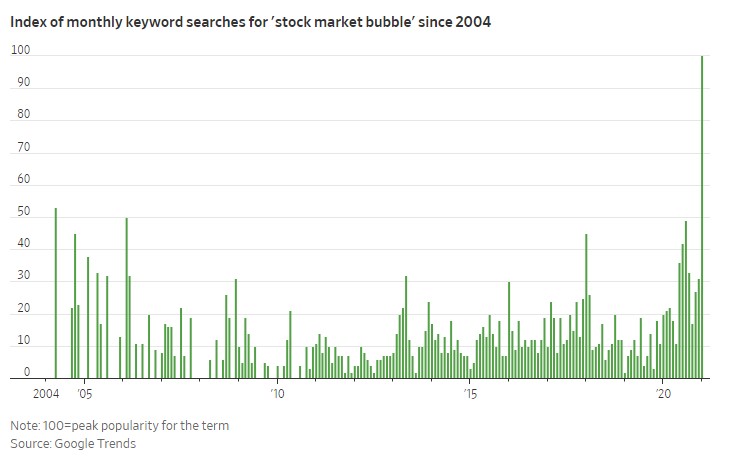

To many, valuations look stretched as they hover at levels similar to the highflying days of 2000. That said, high valuations alone don’t necessarily mean the rally is near its end, investors say. History has shown that markets have often been able to climb far longer than thought possible, be it the dot-com boom in the late 1990s or the dizzying rise in Japanese stocks in the 1980s. An even bigger issue arguing against a marketwide bubble is simple math. With interest rates at rock bottom and further stimulus on the table, many investors are being handsomely rewarded by putting their money into riskier, higher-yielding assets. What’s more, in many cases earnings have held up or been robust, despite a global pandemic.

Investors are trying to identify what could cause bubbles among individual stocks to pop and whether any of the bursts will spread to the wider market. Next week, investors will get a look at fresh data on the manufacturing sector, earnings from Amazon.com Inc. AMZN 0.63% and Google parent Alphabet Inc. GOOG 1.73% and the January employment report.

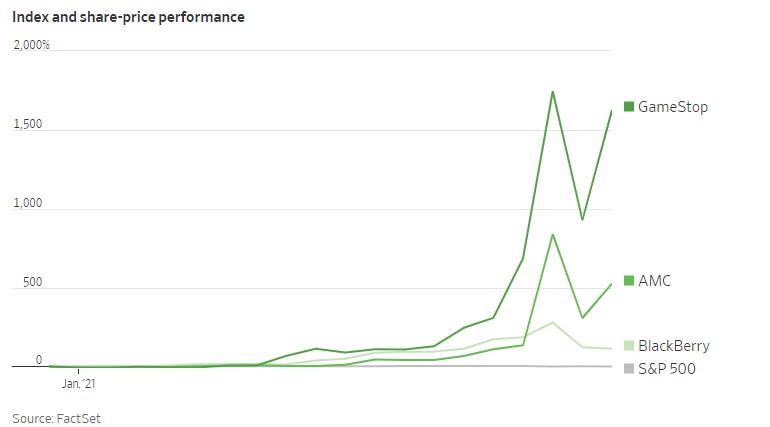

More individual investors are trading than ever before. Those investors threw their weight around last year by shocking Wall Street veterans with a rash of irrational stock picks, including Hertz Global Holdings Inc., HTZGQ 2.78% which spiked nearly 900% from its low to its high in the wake of filing for bankruptcy protection. Companies have raised $13.4 billion through 24 IPOs so far this year, a 300% jump in listings from the same period last year, according to Renaissance Capital data. Blank-check companies continued to flood the market, with 91 gathering about $25 billion, nearly a third of the value raised throughout all of last year, according to SPACinsider.com. And there have been 111 offerings of additional shares by U.S.-listed companies, doubling the number from the same period a year earlier, Dealogic data show.

Usually, such frenzied activity would lead big money managers to pull back from stocks. But many argue that shares of GameStop, AMC and other highflying stocks represent their own bubbles—and don’t pose a threat to the entire financial ecosystem. Analysts at Goldman Sachs Group Inc. GS -0.09% say the run-up in unprofitable stocks, which they say make up about 5% of the overall market, poses little risk of contagion.

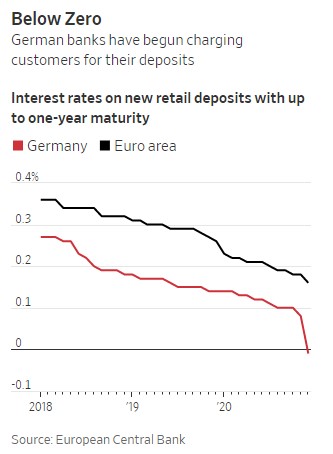

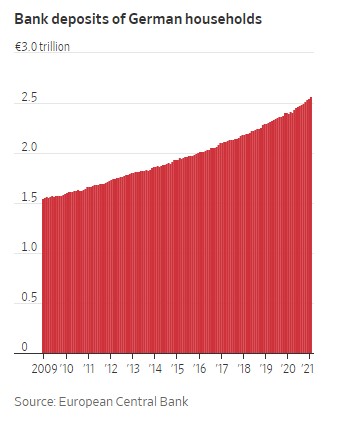

Interest rates have been negative in Europe for years. But it took the flood of savings unleashed in the pandemic for banks finally to charge depositors in earnest.That is creating an unusual incentive, where banks that usually want deposits as an inexpensive form of financing, are essentially telling customers to go away. Banks are even providing new online tools to help customers take their deposits elsewhere.

Banks in Europe resisted passing negative rates on to customers when the ECB first introduced them in 2014, fearing backlash. Some did it only with corporate depositors, who were less likely to complain to local politicians. The banks resorted to other ways to pass on the costs of negative rates, charging higher fees, for instance.

According to price-comparison portal Verivox, 237 banks in Germany currently charge negative interest rates to private customers, up from 57 before the pandemic hit in March of last year. Charges range between 0.4% and 0.6% for deposits beginning anywhere from €25,000 to €100,000.

Business in Germany, has risen sharply as more banks have begun charging for deposits. The number of customers using its platforms across Europe rose more than 40% to 325,000 in 2020. The volume of deposits that moved through the platforms rose by 50% to about €30 billion. It also works with a handful of banks in Germany and elsewhere in Europe, embedding its service inside bank websites, making it easy for customers to shift their money. Deutsche Bank, which charges a negative rate to new customers holding more than €100,000, bought a stake in a Raisin competitor called Deposit Solutions. Deutsche Bank clients use Deposit Solutions to pick deposit offerings currently at five different banks, including in Italy, Austria and France.

The ECB’s deposit rate, which it charges banks, is minus 0.5%. The central bank has signaled it is unlikely to change that level anytime soon. Government bond yields, against which borrowing costs are measured, are negative despite a recent uptick. German 10-year bunds yield minus 0.3%. Similar U.S. bonds yield 1.5%.

Our information/charts are NOT buy/sell recommendations. Are strictly provided for educational purposes only. Trade at your own risk and analysis.

Contact our advisors through website chat 24/7.

Mobile operator Vodafone reported a 1.2% drop in full-year adjusted earnings, coming in at the bottom of its guidance and missing market expectations, but forecast growth this year. The company posted adjusted EBITDA (earnings before tax, interest, depreciation and amortization) of 14.4 billion euros on revenue of 43.8 billion euros, down 2.6%, for the year.

Our information/charts are NOT buy/sell recommendations. Are strictly provided for educational purposes only. Trade at your own risk and analysis.

Contact our advisors through website chat 24/7.

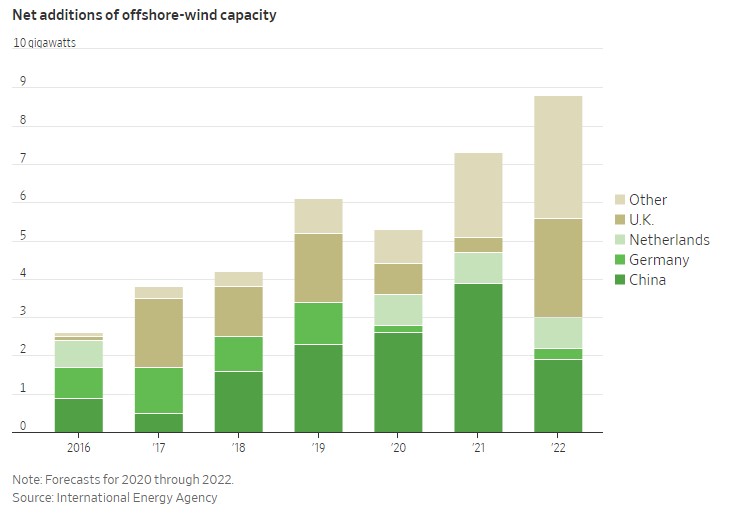

After two decades hauling cement and fuel to oil rigs in the North Sea, Atlantic Discovery faced the end of the line in 2015 when energy markets crashed and the ship was dispatched to an Edinburgh scrapyard.

Now the vessel is back plying the waves under a new owner. Tricked out with high-lift cranes and an upgraded positioning system, it started servicing the U.K.’s offshore wind farms in 2019.

Ships clear the seabed of debris, lay foundations and build turbines—often far from shore in treacherous conditions. A financing gap exists because banks have pulled back from the shipping industry after losses since the 2008-09 financial crisis.

Vessels that install turbines can cost between $250 million and $350 million to build, while those that service them can cost up to $50 million.

Some managers are currently participating in a tender to provide ships for Dogger Bank wind farm, off the northeast coast of England, whose owners SSE Renewables and Equinor AS A say it will be the world’s biggest. Vessels can be retrofitted after serving oil-and-gas rigs or built from scratch, according to Elbe Financial Solutions, a firm that previously invested in traditional ships. Two years ago it shifted to an environmental maritime strategy that includes offshore wind vessels.

Most offshore wind farms are in Europe and Asia. The U.S. is on track to become one of the largest markets, though overseas investors face stringent regulation there.

Wind-turbine installation vessels attach to the seabed and lift themselves out of the water. Using that stable platform, a crane and other machines install the turbine’s foundation, construct a tower and attach blades that capture wind power. They tend to be a riskier bet for investors because they regularly need to find new farms under construction, and can return as much as 20%.

Vessels that transfer technicians to maintain and repair turbines are typically a safer investment because they are chartered for years at a time, producing at least high single-digit returns.

Appaloosa LP Cuts Share Stake In Disney.

Our information/charts are NOT buy/sell recommendations. Are strictly provided for educational purposes only. Trade at your own risk and analysis.

Contact our advisors through website chat 24/7.

Low-carbon funds, which seek to invest more in companies that pollute less, are part of the boom in ESG—environmental, social and governance—strategies. On April 8, BlackRock launched its U.S. Carbon Transition Readiness exchange-traded fund, raising roughly $1.25 billion, the biggest first day in the nearly 30-year history of ETFs.

You need to understand two fundamental facts about ESG or “sustainable” investing. First, corporate responsibility is in the eye of the beholder; one investor’s paragon is another’s pariah. Second, ESG is the last best hope for investment firms seeking to hang onto fat fees.

In the first quarter of 2021, exchange-traded ESG portfolios listed in the U.S. took in $14.8 billion in new money, according to ETFGI, a research firm in London. More than half their total assets of $86.2 billion have flowed in since the beginning of 2020.

Professional investors and rating services disagree widely on how to rate corporate responsibility. You could admire Tesla Inc. for reducing society’s reliance on internal-combustion engines—or reproach it for squandering electricity on bitcoin and relying on batteries made with lithium, which can be hazardous and difficult to recycle. At least as big a push comes from investment managers. With market-matching index funds beating traditional stock pickers, it’s become harder to keep charging high fees.

Investors, it seems, are more likely to put up with low returns and high fees if you enable them to feel righteous.

Some sustainable portfolios exclude companies or entire industries, such as coal or weapons manufacturers. Others hold stock in companies they don’t regard as leaders but seek to rehabilitate.

The new BlackRock U.S. Carbon Transition Readiness ETF takes a third approach.

The Carbon Transition fund doesn’t exclude lots of stocks. Instead, it holds slightly above-average stakes in the companies BlackRock believes are making the most progress toward a low-carbon world—and owns a bit less of those it considers laggards. The fund applies those tilts to each of its approximately 350 holdings. The result is a basket of stocks the average investor might find indistinguishable from the market as a whole.

The Carbon Transition fund’s top five companies, totaling 19.5% of total assets, are Apple Inc., Microsoft Corp. , Amazon.com Inc., Facebook Inc. and Google’s parent Alphabet Inc. After a fee waiver, the fund charges 0.15% in annual expenses.

A sibling fund, iShares Core S&P 500 ETF, holds the identical top five companies, in slightly different order and at 21.5% of total assets, for an annual expense of only 0.03%.

What’s more, BlackRock argues, the tweaks it makes to the size of holdings—for instance, 1.26% in Berkshire Hathaway Inc. and 1.173% in JPMorgan Chase & Co., versus 1.28% and 1.166%, respectively, in the Russell 1000 fund—add up to a huge difference in carbon impact. That isn’t easy for outsiders to verify independently. Estimates of emissions can be unreliable. And auditing the carbon impact of every aspect of corporate operations—from sourcing raw materials to manufacturing and distribution—is complex and difficult. So different analysts can assign wildly divergent scores to the environmental goodness of a given company.

Individual investors should remember that annual expenses on sustainable ETFs charge an average 0.34% to invest in U.S. stocks, according to Morningstar—more than 10 times the cheapest index funds. In that sense, ESG funds are Wall Street’s latest way to take something old, call it new and jack up the price.

Eli Lilly And MiNA Therapeutics Announce saRNA Research Collaboration.

Our information/charts are NOT buy/sell recommendations. Are strictly provided for educational purposes only. Trade at your own risk and analysis.

Contact our advisors through website chat 24/7.