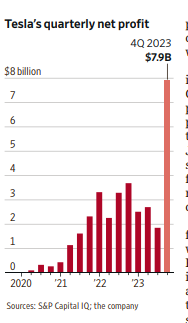

Tesla’s net income more than doubled to $7.9 billion in the fourth quarter

Tesla cautioned that growth is likely to come in lower in 2024 than it did last year without specifying a target. In 2023, its global vehicle deliveries increased 38% over the prior year; and for several years, Tesla had been aiming for 50% annual growth on average.

For the fourth quarter, Tesla’s net income more than doubled to $7.9 billion, largely due to a one-time tax benefit. But the company’s income from operations was down 47% from the prior-year period, and its fourth-quarter revenue came in shy of analysts’ expectations.

Adjusted earnings per share of 71 cents for the fourth quarter also missed Wall Street’s estimates.

Its operating margin improved slightly quarter-over-quarter to 8.2% for the final three months of the year.

Tesla cautioned that growth is likely to come in lower in 2024 than it did last year without specifying a target. In 2023, its global vehicle deliveries increased 38% over the prior year; and for several years, Tesla had been aiming for 50% annual growth on average.

For the fourth quarter, Tesla’s net income more than doubled to $7.9 billion, largely due to a one-time tax benefit. But the company’s income from operations was down 47% from the prior-year period, and its fourth-quarter revenue came in shy of analysts’ expectations.

Adjusted earnings per share of 71 cents for the fourth quarter also missed Wall Street’s estimates.

Its operating margin improved slightly quarter-over-quarter to 8.2% for the final three months of the year.

"The outlook for 2024 is very similar to that 12 months ago. Economies, consumers and earnings were resilient in 2023 and the forecast economic slowdown has been rolled into 2024," the bank said.

"We maintain a defensive bias as we start the year as we expect higher inflation and interest rates to finally catch up with consumers and earnings."

JP Morgan said it was downgrading WPP due to slowing US macro conditions and share losses.

WPP reported in October that group like-for-like revenues were up 1.2% across the first nine months of 2023, as growth in the UK, Western and Continental Europe, and Rest of World divisions was offset a 2.2% LFL slump in North America.

"The outlook for 2024 is very similar to that 12 months ago. Economies, consumers and earnings were resilient in 2023 and the forecast economic slowdown has been rolled into 2024," the bank said.

"We maintain a defensive bias as we start the year as we expect higher inflation and interest rates to finally catch up with consumers and earnings."

JP Morgan said it was downgrading WPP due to slowing US macro conditions and share losses.

WPP reported in October that group like-for-like revenues were up 1.2% across the first nine months of 2023, as growth in the UK, Western and Continental Europe, and Rest of World divisions was offset a 2.2% LFL slump in North America.

Revenue increased 12.5% from a year earlier, to $8.8 billion in the final quarter of 2023, beating its expectations. Net profit for the period rose to $938 million, missing the company’s forecast of $956 million.

Operating margin rose to 16.9% in the quarter from 7% a year earlier, above the 13.3% it projected.

Revenue increased 12.5% from a year earlier, to $8.8 billion in the final quarter of 2023, beating its expectations. Net profit for the period rose to $938 million, missing the company’s forecast of $956 million.

Operating margin rose to 16.9% in the quarter from 7% a year earlier, above the 13.3% it projected.

The company may also come under significant margin pressure in the next two years due to lower-than-expected new project numbers in 2023 and delays in mega projects, the analysts add. UOB Kay Hian cuts Wuxi Bio's rating to sell from hold and lower its target price to HK$22.00 from HK$47.00 given the much lower guidance.

The company may also come under significant margin pressure in the next two years due to lower-than-expected new project numbers in 2023 and delays in mega projects, the analysts add. UOB Kay Hian cuts Wuxi Bio's rating to sell from hold and lower its target price to HK$22.00 from HK$47.00 given the much lower guidance.

TSMC expects revenue in 2024 to grow more than 20% from last year. The smartphone market has finally started to expand again: Global shipments in the fourth quarter of 2023 grew 8.5% year on year, according to International Data Corporation—compared with a 3.2% decline for the whole of 2023.

TSMC expects revenue in 2024 to grow more than 20% from last year. The smartphone market has finally started to expand again: Global shipments in the fourth quarter of 2023 grew 8.5% year on year, according to International Data Corporation—compared with a 3.2% decline for the whole of 2023.

Moody's says the move is credit-negative, but the agency does not believe it signals a shift in overall financial policy, and therefore GM's ratings and outlook are "unaffected." S&P Global says the company will have enough positive cash flow to handle investments in electrification and other technology, "therefore, all of our ratings on GM are unchanged," S&P says

GM expects to generate operating profit of $11.7 billion to $12.7 billion this year, which is slightly lower than its previous forecast. GM also expects to generate free cash flow of $10.5 billion to $11.5 billion this year, higher than a previous forecast.

Moody's says the move is credit-negative, but the agency does not believe it signals a shift in overall financial policy, and therefore GM's ratings and outlook are "unaffected." S&P Global says the company will have enough positive cash flow to handle investments in electrification and other technology, "therefore, all of our ratings on GM are unchanged," S&P says

GM expects to generate operating profit of $11.7 billion to $12.7 billion this year, which is slightly lower than its previous forecast. GM also expects to generate free cash flow of $10.5 billion to $11.5 billion this year, higher than a previous forecast.

The price target change comes as the bank moves its valuation to a target price-to-earnings multiple of 11x, applied to its higher earnings estimates.

"We move back to a PE methodology as easyJet's earnings and leverage have improved after the pandemic," it said.

"At 9x FY24E P/E, the shares trade below their 12x historical average, which we think is unjustified, given solid earnings growth prospects and a strong balance sheet."

The price target change comes as the bank moves its valuation to a target price-to-earnings multiple of 11x, applied to its higher earnings estimates.

"We move back to a PE methodology as easyJet's earnings and leverage have improved after the pandemic," it said.

"At 9x FY24E P/E, the shares trade below their 12x historical average, which we think is unjustified, given solid earnings growth prospects and a strong balance sheet."

On Antofagasta, UBS said the bottom-up investment case was at an inflection.

It said Anto has had a challenging two to three years that resulted in guidance downgrades, declining output, significant increases in unit costs and capex for key projects at Los Pelambres lifting materially eroded returns.

"Looking forward, in our view, Anto's bottom-up investment case is attractive," it said.

"We expect a combination of organic volume growth and unit cost improvement to drive superior earnings growth versus mining peers (diversified and copper pure plays apart from Ivanhoe) in the next three to five years and believe earnings growth (rather than the re-rating/large dividends) will drive attractive returns."

On top of this, UBS said reckons the copper market is also close to a fundamental inflection point and that Anto is one of the few "lower risk" large cap global copper miners that offers leverage to copper price upside.

On Antofagasta, UBS said the bottom-up investment case was at an inflection.

It said Anto has had a challenging two to three years that resulted in guidance downgrades, declining output, significant increases in unit costs and capex for key projects at Los Pelambres lifting materially eroded returns.

"Looking forward, in our view, Anto's bottom-up investment case is attractive," it said.

"We expect a combination of organic volume growth and unit cost improvement to drive superior earnings growth versus mining peers (diversified and copper pure plays apart from Ivanhoe) in the next three to five years and believe earnings growth (rather than the re-rating/large dividends) will drive attractive returns."

On top of this, UBS said reckons the copper market is also close to a fundamental inflection point and that Anto is one of the few "lower risk" large cap global copper miners that offers leverage to copper price upside.

In addition, he points to the bank's leverage to a capital markets recovery and its strong capital and loan loss reserve levels.

"And while we wouldn't argue JPM shares are cheap, they also aren't expensive at 11.5x our 2024e or just a slight premium to the broader group multiple of 11.0x," O'Connor wrote in a note to clients.

In addition, he points to the bank's leverage to a capital markets recovery and its strong capital and loan loss reserve levels.

"And while we wouldn't argue JPM shares are cheap, they also aren't expensive at 11.5x our 2024e or just a slight premium to the broader group multiple of 11.0x," O'Connor wrote in a note to clients.

The quarter’s results were solid and closely in line with our expectations. Sales of $9.3 billion rose 4% year over year and 5% sequentially, with growth in both semiconductors and software. Broadcom’s networking chips continue to see impressive demand, largely driven by AI, and it saw typical seasonal strength for its wireless chips that sell into Apple’s products like the iPhone. Broadcom’s other chip markets of broadband and storage are softening, and we expect this to continue through fiscal 2024. Non-GAAP gross and operating margins of 74% and 62%, respectively, were within typical ranges for the firm and remain extremely impressive.

The quarter’s results were solid and closely in line with our expectations. Sales of $9.3 billion rose 4% year over year and 5% sequentially, with growth in both semiconductors and software. Broadcom’s networking chips continue to see impressive demand, largely driven by AI, and it saw typical seasonal strength for its wireless chips that sell into Apple’s products like the iPhone. Broadcom’s other chip markets of broadband and storage are softening, and we expect this to continue through fiscal 2024. Non-GAAP gross and operating margins of 74% and 62%, respectively, were within typical ranges for the firm and remain extremely impressive.