Investing in Biotechnology: risk and rewards

Biotechnology is an exciting industry, the future of healthcare, where technology creates medicine tailored to individuals. Over the past decade, progress in biotechnology has accelerated rapidly. It ranks among the most attractive of all fast growing industries with an estimated annual growth rate of more than 10% p.a.

However, Investing in biotechnology faces many types of risks. Most of the biotech companies are generally small enterprises that engage solely in Reaserch&Development (R&D) of medicines. These companies use biotechnology to revitalize the function of cells for a specific purpose. The R&D process involves many clinical testing trials. In fact, neither the companies nor the investors, have any knowledge of the outcomes. The length of time from research and development is extremely long, averaging 10-15 years. In most cases, these companies can live or die based on that results.

The volatility of biotech stocks

The decision to invest in pharmaceutical or biotech stocks is a confusing one unless you have an in-depth knowledge. Biotech stocks trade based on drug data including trial failures. The competition and regulatory obstacles are also important features. If the data misses its expected result, a biotech's stock can lose most of its value that day. On the other hand, if a drug meets its endpoint, a stock can soar by triple digits that day. An investment in a biotech company might suit your style if you are a risk taker and willing to wait for drug development while facing the potential volatility generally associated with biotech stocks.

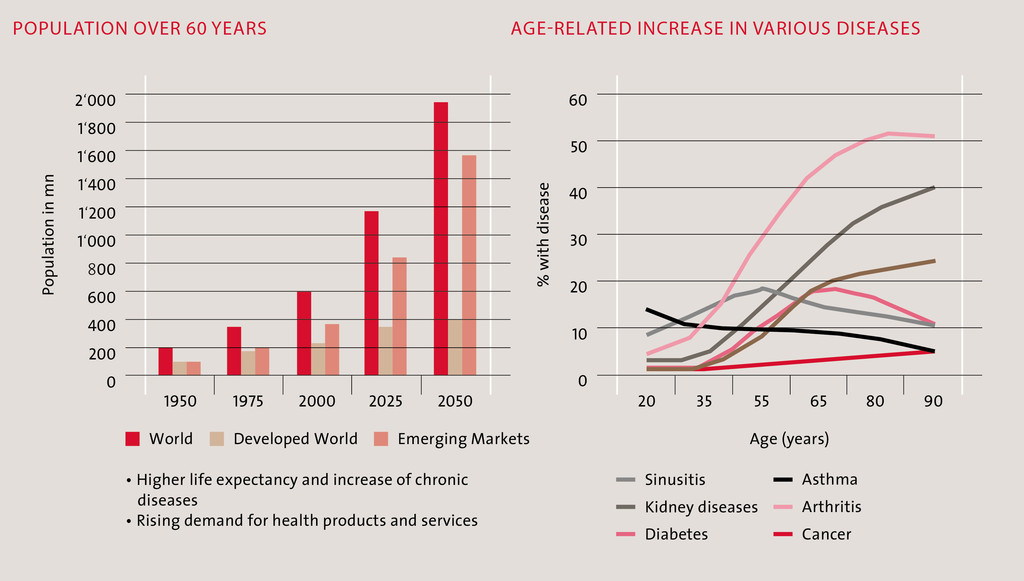

While biotech companies engage solely in R&D of medicines, pharmaceutical companies engage in many activities from research and development (R&D) to manufacturing and marketing medicines. Biotech companies tend to find partners for financial support, usually through venture capital, universities, pharmaceutical companies or the government. For examples, researchers show recently that infection by Zika caused the death of cells from glioblastoma, the most common and aggressive kind of malignant brain tumor in adults. Scientists foresee the use of genetic engineering to neutralize Zika virus' infectious while preserving the viral particles which induce the death of tumoral cells. This discovery was made byresearchers at the University of Campinas's School of Pharmaceutical Sciences (FCF-UNICAMP) in São Paulo State, Brazil. One of the greatest achievements of our civilization is higher life expectancy. The United Nations estimates that the global population will rise by one-third between 2010 and 2050 to a total of 9.1 billion people. The proportion of people over 60 will rise from 760 million to 2 billion. Unfortunately, the population aging is associated with an increase in age-related diseases.

Important deals in Biotechnology

There is also a higher demand for treatment of age-related neurodegenerative conditions such as Alzheimer’s disease. AbbVie, a research-based biopharmaceutical company, has announced a new drug research collaboration with Voyager Therapeutics, which will focus on the creation of new therapies for neurodegenerative diseases. This important deal consists of developing gene therapies for Alzheimer’s disease and includes a $69 million upfront payment to Voyager and more than $1 billion in potential milestone payments.

AbbVie is looking at ways to tackle Alzheimer’s beyond tau, one of the two main proteins implicated in Alzheimer’s. The firm already has an anti-tau antibody in Phase II clinical trial. Voyager will test encoding different versions of the antibodies into the DNA of an adeno-associated virus (AAV), a delivery vehicle used in many gene therapy trials to shuttle DNA into cells. In October, the firm invested $225 million in South San Francisco-based Alector, which is designing antibodies that modulate the activity of immune cells found in the brain called microglia. Tau is one of the most common Alzheimer’s drug targets, along with amyloid-β, a protein that clumps into plaques that clog up the spaces between brain cells. But no one has successfully developed a drug based on reducing the buildup of amyloid-β or tau.

Charles River Laboratories (NYSE: CRL), a contract research company that supports the development of a significant percentage of drugs that the FDA approves (70% in 2016, according to the company's website), announced the acquisition of MPI Research in February for around $800 million in cash.

The acquisition is expected to be accretive to non-GAAP EPS by about $0.25 this year and $0.60 in 2019. It is expected to be financed through an expansion of Charles River’s existing credit facility and cash.

The purchase price implies multiples of 11.7x non-GAAP EBITDA for 2017 and 10.5x non-GAAP EBITDA for 2018 based on estimated results for MPI including operational synergies. The transaction, expected to close early in Q2, is expected to add $170 to $190 million to Charles River’s 2018 consolidated revenue and $260 to $280 million to 2019 consolidated revenue. The company had 11,662 employees as of last fall, including 1,466 in Massachusetts. It is the ninth largest life sciences employer in the state