China Gives Market More Say in Setting Yuan’s Value

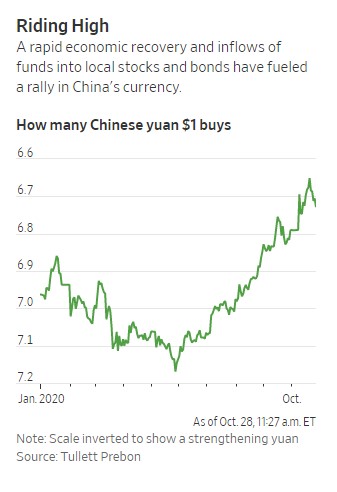

China is giving investors more power in setting the value of the yuan, a move analysts said was likely intended to boost the currency’s international appeal rather than to drive it lower. In onshore markets, the yuan is allowed to trade only in a narrow range around a daily midpoint set by the central bank. That level is set using previous traded prices from Chinese banks, but until now banks have sometimes adjusted their inputs using what is known as a countercyclical factor. The result has been to make the currency less volatile and to slow any selloff when the yuan was under pressure.

Chinese banks have recently stopped using the factor, the China Foreign Exchange Trade System said late Tuesday, adding that the suspension could help make the daily fixing mechanism more transparent and efficient. The CFETS is an arm of the People’s Bank of China. Making the system less opaque, and more reflective of market prices, could boost the yuan’s appeal to investors. China’s leaders are eager to attract more foreign capital to their markets and to bolster broader international use of the yuan for trade and finance, rather than having to rely too much on transacting in dollars. At the same time, too weak of a currency could invite fresh U.S. accusations that Beijing is deliberately keeping the yuan undervalued to supercharge exports.

Contact our advisors through website chat 24/7