Investors Find New Safe Place to Hide: Chinese Bonds

Investors seeking shelter from the turbulence in markets have found a new haven: Chinese sovereign bonds.

Foreign capital flowed into locally denominated Chinese government bonds in the second quarter at the fastest pace since late 2018, according to data from CEIC, an economic data provider. It surpassed 4.3 trillion yuan ($619 billion), the highest on record.

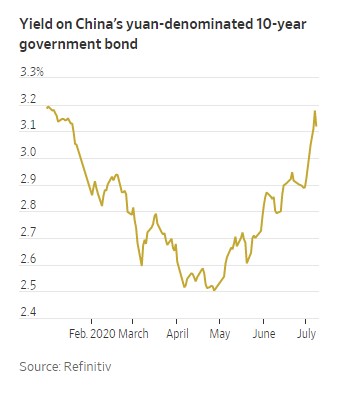

International ownership of China’s debt has been on the rise in recent years as Beijing has made it easier to buy and sell and after the securities were added to key bond indexes beginning in 2019. Passive bond funds try to match the composition of those indexes. And active investors have found the relatively higher yield and stability of the Chinese bond market attractive.

Investors seeking shelter from the turbulence in markets have found a new haven: Chinese sovereign bonds.

Foreign capital flowed into locally denominated Chinese government bonds in the second quarter at the fastest pace since late 2018, according to data from CEIC, an economic data provider. It surpassed 4.3 trillion yuan ($619 billion), the highest on record.

International ownership of China’s debt has been on the rise in recent years as Beijing has made it easier to buy and sell and after the securities were added to key bond indexes beginning in 2019. Passive bond funds try to match the composition of those indexes. And active investors have found the relatively higher yield and stability of the Chinese bond market attractive.